What to Know About the Corporate Transparency Act

The Corporate Transparency Act (CTA), a new federal law expected to go into effect on January 1, 2024, will affect approximately 32.6 million small and

The Corporate Transparency Act (CTA), a new federal law expected to go into effect on January 1, 2024, will affect approximately 32.6 million small and

Commercial lease agreements happen often, especially with small businesses. Leases can be short-term, for a few months or up to five years, while others can

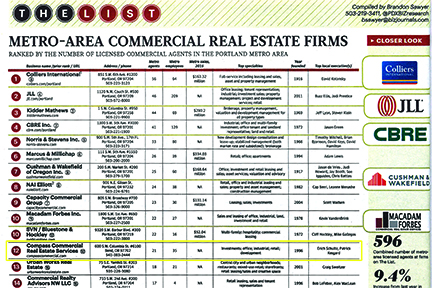

The Portland Business Journal released an updated ranking of commercial real estate firms in a special report on March 10, 2017. Compass Commercial currently ranks

Working in leasing and sales at Compass Commercial Real Estate Services, our brokers, property managers and construction services have seen the gamut of old and

How community property ownership affects your real property As a team, we are interested in continuing education for our team members. For one of our recent

Portland Business Journal released their Book of Lists for 2017. We maintained our position at #12 on the list of commercial real estate firms in

Oregon Business News magazine released its 2017 Powerbook. Compass Commercial ranks in the top 10 on its list of commercial real estate firms. We moved