By Erich Schultz, SIOR

Q4 2014 Compass Points – 2014 Summary and Looking Ahead in 2015

It’s official — the worm has turned. In the current market, buyers and tenants no longer hold all of the cards, as landlords and sellers now have equal or greater leverage in negotiations. As you know, real estate is cyclical. So this phenomenon was destined to occur. There should be no hard feelings though, as the change signals a greatly improved economy. Landlords and sellers are entitled to make a profit— something that has escaped most investors for the past six years or so.

Q4 2014 Bend Office Market

Q4 2014 Bend Retail Market

Q4 2014 Bend Industrial Market

Q4 2014 Redmond Industrial Market

Downloadable PDF of Q4 2014 Compass Points

Industrial Market Review

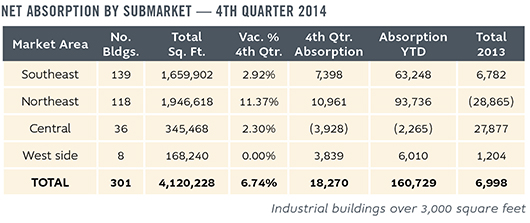

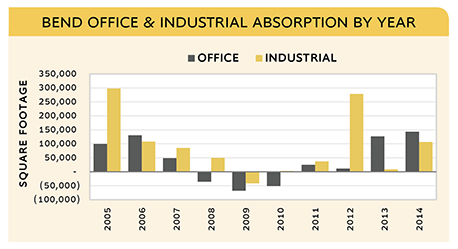

The Bend industrial market began its recovery in 2013 and continued to gain momentum this past year. Since the end of 2013, net absorption increased from 6,998 square feet to 160,729 square feet by the end of 2014. The activity in 2014 is consistent with “normal” activity for Bend.

Bend’s overall industrial vacancy rate dropped from 12.3% to 6.8%. As available inventory has decreased, rental rates have continued to improve. Today, rates start at $0.45 per square foot per month, triple net for larger and older properties and around $0.55 to $0.65 per square foot per month, triple net for smaller and newer buildings.

Office Market Review

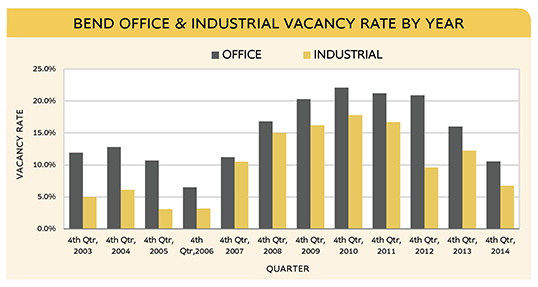

This past year marked the beginning of the end of the recession for the office market as this product market is roughly one year behind that of industrial. In 2014, absorption increased from 126,754 square feet to 143,700 square feet. The vacancy rate dropped from 16% at the end of 2013 to 10.5% and rents have started to firm up. Today, office rates start at $1.20 per square foot per month, triple net and go as high as $1.70 per square foot per month, triple net.

Significant new construction is still a ways off. Land owners are holding out for top dollar, which makes development financially unfeasible (and un-financeable in some cases). In addition, the supply of land in Bend remains constricted as a wearisome seven-year effort to expand the Urban Growth Boundary continues. The little inventory of industrial land that Bend has available is priced from $5.00 to $15.00 per square foot. Construction costs have continued to creep up while labor, materials and government fees seem to increase regardless of the state of the economy or demand. Rents have not increased at the same rate and do not yet support these cost levels.

Looking Ahead

With a shortage of new construction on the drawing board, rents for both office and industrial product types will go up in 2015. As absorption continues to benefit from the improved local and national economies, rents will only continue to escalate in the short to mid-term and vacancies will continue to drop.

As rents rise, expect developers to start aggressively looking for sites for their next projects. We expect that the first developers that get projects started will be those with some sort of cost advantage, such as contractors who can contribute their fees toward a project, or owners with a low basis in their land.

A Growing Trend

If you believe that Colorado’s experience over the past two years offers a preview of what we can expect to unfold in Oregon, then the industrial market will see new demand from an increasing number of marijuana growers. Still, banks and credit unions face the prospect that federal regulators will shut them down for doing business with marijuana enterprises. Today, landlords may be in violation of their loan covenants if they lease to a tenant in the pot industry. New construction based upon pre-leasing to growers cannot be financed by banks. The dicey conflict between state and federal laws will need correction before owners can move forward with confidence in this arena. Still some property owners are currently benefitting from the industry. Those with no bank debt can do as they please. However, depositing rent into a bank account from marijuana based tenants could be an issue. Others may throw caution to the wind in order to capture the premium rents that these tenants are willing to pay. Well-financed participants in the marijuana industry will be buying property as well.

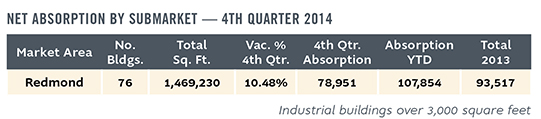

Redmond and Prineville

Price conscious industrial space users may have to give Redmond or Prineville serious consideration. There is greater availability in Redmond as the vacancy rate is 10.5%. Base rents range from $0.30 to $0.40 per square foot per month, triple net. Industrial land in Redmond is more affordable as well. Sites can be acquired for $2.50 to $5.00 per square foot. Prineville rents are even less. They range from $0.15 to $0.30 per square foot per month, triple net. Land prices range from $1.00 to $3.00 per square foot.

Multifamily

The lack of available land is affecting the multifamily/residential market as well. Reports over the last 12 to 18 months have shown Bend’s apartment vacancy rate standing at 1% or less. Normally, developers would be constructing projects to take advantage of the supply imbalance and a few are. However, there is even less land zoned for multifamily development than there is industrial land. Developers from across the state and beyond have come, they have seen and they have left empty handed for the most part. Meanwhile, those landlords that are holding existing apartments are enjoying historically high rents.

Hospitality

Hospitality is one product type that has felt the least amount of impact from the lack of availability and high cost of land. In 2014, a new Hampton Inn & Suites completed construction and opened on the west side of the Deschutes River in the Old Mill District. Spring Hill Suites has proposed a development between the Old Mill District and downtown, while a My Place Hotel in the Old Mill District is in the pre-development stage. According to Visit Bend, the citywide hotel occupancy rate is about 69% and the average daily rate and citywide revenue per available room are in record territory. Mixed-use zoned land in the Old Mill District and surrounding area is trading for $20 to $25 per square foot.

Q4 2014 Bend Office Market

Absorption up, Vacancy down

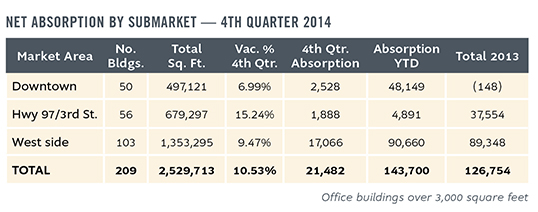

Compass Commercial surveyed 209 buildings for the fourth quarter office report. The buildings in the sample totaled nearly 2.53 million square feet. The fourth quarter recorded 21,482 sq. ft. of positive absorption, causing Bend’s office vacancy rate to decrease from 11.3% to 10.5% as a result. This is the 10th consecutive quarter of positive absorption. There is now just over 266,000 sq. ft. of available space for lease.

Downtown

The downtown submarket recorded a modest 2,528 sq. ft. of positive net absorption in the fourth quarter. The office vacancy rate downtown now stands at 7.0%. The last time downtown had an office vacancy rate in single digits was nearly eight years ago! There are some storm clouds on the horizon however. Karnopp Peterson will be relocating from its long-time home at 1201 NW Wall Street in the spring. This will free up all three floors of this building (24,000 sq. ft. total) for one or more tenants. The building is also available for sale.

Highway 97/3rd Street

The Highway 97/3rd Street corridor recorded 1,888 sq. ft. of positive net absorption in the fourth quarter. Empire Corporate Park stood out as the top performer with over 5,000 sq. ft. reported leased spread over two of its buildings. The vacancy rate decreased slightly and now stands at 15.2%.

West Side

The west side submarket, which contains 53.5% of the general office inventory, recorded 17,066 sq. ft. of positive net absorption. The vacancy rate dropped to 9.5% from 10.7% as a result. Nine buildings reported positive net absorption. The 1001 SW Emkay Drive building was the top performer in this submarket with several new tenants signing leases totaling about 12,000 sq. ft. in this high tech hub.

Q4 2014 Bend Retail Market

Absorption up, Vacancy down

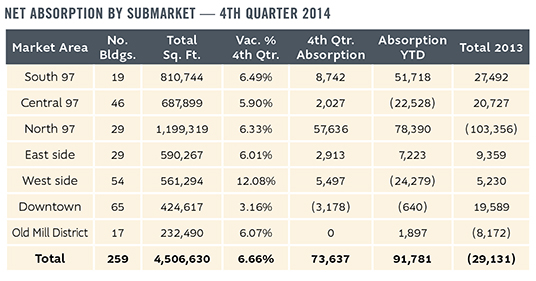

Compass Commercial surveyed 259 retail buildings totaling over 4.5 million sq. ft. for the fourth quarter 2014 retail report. The citywide vacancy dropped significantly from 8.3% in Q3 to 6.7% at the end of the year due to 73,637 sq. ft. of net positive absorption. This brought the 2014 total to a respectable 92,000 sq. ft. of positive absorption.

Compass Commercial breaks the Bend retail market down into seven submarkets. All but one, the downtown submarket, reported positive absorption for Q4. The north Highway 97 submarket was the strongest for the quarter, recording 57,636 sq. ft. of absorption due to Hobby Lobby’s lease of the former Sears space at the Bend River Promenade. In comparison, the other submarkets came in with between 2,000 and 9,000 sq. ft. of absorption. Despite the previously mentioned negative quarterly result downtown, this area has the lowest vacancy rate (3.2%) of the submarkets.

Q4 2014 Bend Industrial Market

Absorption up, Vacancy down

Compass Commercial surveyed 301 buildings for the year-end industrial report. The buildings in the sample totaled over 4.12 million square feet. The citywide industrial vacancy rate decreased from 8% to 6.7% in the fourth quarter of 2014. At the end of 2013, the vacancy rate was 12.25%. There is roughly 278,000 sq. ft. of available space for lease. For the year, there was 161,000 sq. ft. of positive net absorption. This suggests the available inventory represents less than a two-year supply.

Southeast

The southeast submarket recorded 7,400 sq. ft. of positive net absorption in the fourth quarter. The vacancy rate fell slightly as a result and now stands at 2.9%. Only eight of the 139 buildings surveyed have any vacancy. The largest space leased was 4,000 sq. ft. on Glenwood Drive. Few options remain available in this submarket with the largest availability being 9,300 sq. ft. Rental rates continue to increase and now range from $0.55 to $0.60 per square foot per month, on a triple net basis.

Northeast

The northeast submarket recorded 11,000 sq. ft. of positive net absorption in the last 90 days of the year, where the vacancy rate is now 11.4%. This area of town contains 80% of the vacancy in the city. Still, just nine of the 118 buildings in this submarket reported having any vacancy. Most of these are big spaces appealing to the less common larger tenants. Rental rates in this area of town range from $0.45 to $0.60 per square foot per month, on a triple net basis.

Central

The central submarket recorded 3,928 sq. ft. of negative net absorption placing the vacancy rate at 2.3%. Less than 8,000 sq. ft. remain available in this submarket and just two of the 36 buildings in this submarket reported having any vacancy.

West Side

There was no availability of industrial space in the west side submarket at the end of the year. The only available remaining industrial building at the end of Q3 was a 3,839 square foot space on Century Drive that leased in Q4. The vacancy rate at the end of 2013 was at 3.4%.

Q4 2014 Redmond Industrial Market

Absorption up, Vacancy down

In the fourth quarter, Compass Commercial surveyed 76 industrial buildings totaling nearly 1.47 million square feet. Six buildings reported a combined 79,000 sq. ft. of positive absorption this quarter. The Redmond Mill Site reported a total of 35,000 sq. ft. leased to several tenants. In addition, the Dimeo Building on Veterans Way and 1830 1st Street both signed leases during the quarter. The activity caused the vacancy rate to drop from 15.9% to 10.5%. There is now 154,000 sq. ft. of available space for lease.

Jump to: