Achieving supply and demand equilibrium is always challenging. Just ask any small business owner (think restaurants). In the housing market, it is an ongoing sequence of market cycles. Bend is experiencing a severe housing shortage. Population growth has exceeded the regions’ capacity to produce housing for the last decade. Home prices and rents have skyrocketed.

However, it was only about 14 years ago that there was a glut of housing. Entire neighborhoods sat vacant. Homes prices crashed. Rents plummeted. Apartment vacancies spiked. Builders and developers went broke and left town. Banks were trying to manage a growing inventory of foreclosed homes. How fast things can change, and how quickly we can forget.

No one wants to see that again. But how can the current acute shortage be addressed? At least a partial solution is at hand in the multifamily sector of the housing market. Measuring and forecasting housing supply and demand is an inexact science at best, but let’s take a stab at it.

Bend has grown by just under 3% annually over the last decade. That is a strong rate of growth that has put a strain on housing, traffic, infrastructure and more. Some census experts are forecasting a modest slowing of this growth rate. A population influx of 2,000 to 3,000 per year would create demand for 400-500 new apartment units.

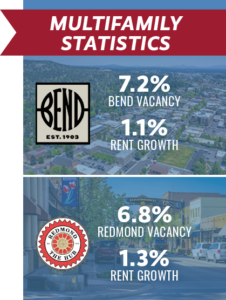

New multifamily deliveries have exceeded this number in the last few years. The vacancy rate is inching upward and rent growth last year was just 1.1%. Supply is catching up. There will likely be over 600 units coming online this year, and there are over 2,000 additional units in the pipeline that could be delivered by 2025. Even if Bend’s growth does not slow and there is a demand for 600 to 700 units per year, there will likely be a surplus of multifamily housing by 2025. CoStar is predicting that vacancy rates could hit double digits and rent growth will be flat or declining for the next few years. The new multifamily development pipeline for both Bend and Redmond looks extremely robust for the foreseeable future.

RELIEF IS ON THE WAY! This should result in a much better housing environment for apartment residents.

It is not necessarily good news for housing providers, but investors and developers understand the ups and downs of market cycles. They have enjoyed a long cycle of rising rents and property values and should be well positioned to withstand the inevitable changing conditions. Rising interest rates and cap rates, and a more difficult lending environment will be additional headwinds in the short term. In the bigger picture, multifamily ownership in Bend, Oregon will always be a winning investment over the long haul providing much needed housing for a growing and vibrant community.

Call us for all your multifamily buying or selling needs or if you want a deeper dive into our market statistics and tracking of the supply and demand equation.