By Adam Bledsoe, Broker

February 7, 2019

On December 22, 2017, the United States Congress passed the Tax Cuts and Jobs Act into public law. As is customary these days, the vote was right down party lines, and the post vote sentiment was likewise either vehemently in favor of or opposed to the new law. While the merits of the bill are still being hotly debated, Subchapter Z of the 186-page law seems to be well-intentioned and logical.

Opportunity Zones (or “OZ” for the balance of this article) were created with the intention of revitalizing the bottom 25% of low-income communities in each state. The law gave state governors the power to designate these zones, somewhat arbitrarily within their state’s borders, whereas some of the zone boundaries drawn are bona fide head scratchers. For instance, in Oregon, there is a massive swath of land in rural Crook, Hines, Klamath and Lake counties that don’t really have any development potential at all. That being said, there are certainly OZ designations that appear to be in lockstep with the nature of the law’s intent.

What You Need to Know:

The basic premise of Subchapter Z is a provision to defer capital gains tax by investing one’s gain into down-trodden areas in exchange for tax relief. Unlike a 1031 Exchange, an individual or entity may invest any capital gain, whether it be from the sale of real estate, stocks, bonds, mutual funds, rare coins, etc. into a Qualified Opportunity Fund (QOF). Capital gains are taxed at rates ranging from zero to a maximum federal rate of 20% plus a 3.8% surtax, but under the provisions in the new tax law, one can defer and lessen the tax consequences of a capital gain.

Qualified Opportunity Funds are investment vehicles that can be created in the form of an LLC, limited partnership or corporation. For one of these funds to invest in the OZ, 90% of the entity’s assets must be applied to the OZ investment.

An Example of Opportunity Zone Tax Advantages:

While the major tax advantage in OZ investment is simply the deferral of capital gain tax payment, there are some aspects in which the tax burden can be lessened by holding the investment for periods of time. As an example, we’ll use Mr. Jones who sold his interest in a mutual fund he had held for the previous five years and realized a gain of $100,000. Here are the steps Mr. Jones could take to maximize his tax advantages by investing the gain in a QOF:

- Instead of paying a capital gain tax of $23,800 in the tax year he realized the gain, Mr. Jones opts to invest in a QOF, and notifies the IRS of his intent in the filing of his tax return for that year.

- He has 180 days from the date of sale of his mutual fund interest to invest in the QOF.

- He creates a QOF as an LLC, and that LLC purchases a building in an OZ for $200,000. This property has a structure value of $50,000 and a land value of $150,000 – this is important, because…

- Within 30 months of the investment, Mr. Jones is required to make improvements to the property equal to the purchase price, but net of the land value – so in this example, $50,000. The improvements also increase his basis, pro rata.

- After holding this property for five years, he gets a 10% step-up in basis – from a tax perspective, it’s as if his initial $100,000 gain is now only a $90,000 gain.

- After holding the property for seven years, he gets an additional 5% step-up in basis – his original gain is now taxable as $85,000.

- If he opts to hold the property for 10 years and decides to sell it for $285,000 (considering a modest 4% appreciation), he is then on the hook to pay capital gain tax on the original gain, discounted 15% — so, $20,230 instead of $23,800.

- By holding the property for 10 years, Mr. Jones pays zero tax on the $105,000 that the property has appreciated, essentially saving another $24,990 in capital gain tax.

- By maximizing the OZ provisions, Mr. Jones has:

- Deferred payment of capital gain tax for 10 years, while putting that money to work;

- Saved $3,570 in tax obligation on the original gain;

- Eliminated $24,990 in capital gain tax on the $85,000 that the property appreciated during the 10 years it was held; and

- Lessened his tax burden by a total of $22,610 or 22.61%.

Grey Areas and Caveats

The example above covers the broad strokes of OZ investing, but there are some other minutiae to consider. As with most tax laws, the passage of the law leaves plenty of ambiguity that becomes clearer during the subsequent rule-making processes. The first rule-making session was completed in October of 2018, and the final rules are set to be completed in the spring of 2019, but here are some aspects to consider:

- Regarding the improvement requirement, there seems to be some ambiguity as to the value of the land versus the value of the structure. Since the law stipulates that one must improve the property equal to the amount invested, net of the land value, this creates a grey area in which investors must be cautious.

- The provision that allows a step-up in basis has a “sunset” of December 31, 2026. So, by de facto, an investor would need to reinvest his gain by the end of 2019 and/or 2021 in order to take full advantage of the 15% and 10% step-up, respectively

- The program only allows tax advantages for the gain that’s been reinvested, not the total purchase price of the reinvestment.

- The program expires entirely in 2028.

- There is plenty of grey area regarding OZs and state taxes. Some states like Colorado, Illinois, New York and Connecticut have opted to fully conform to the federal law, while other states like California, Arizona, Ohio, and Pennsylvania have opted to completely disregard the federal law. Most of the remaining states either have no state capital gains tax or are partially conforming to the federal law.

As it Pertains to Central Oregon

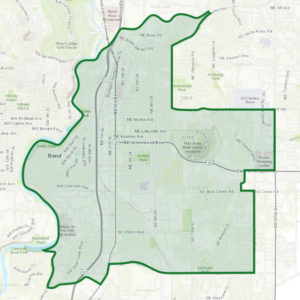

While some OZ boundaries might leave one scratching their head, the boundaries drawn in Central Oregon are quite advantageous. Bend in particular has an OZ boundary drawn around some of its most valuable real estate, stretching from the Deschutes River eastward to 27th Street, and from Reed Market Road north past Butler Market Road – essentially, the busiest corridors in the region (see full PDF map here). Property owners in the OZ should be keenly aware of this situation as the tax incentives are quite enticing to buyers within and outside of the local real estate market.

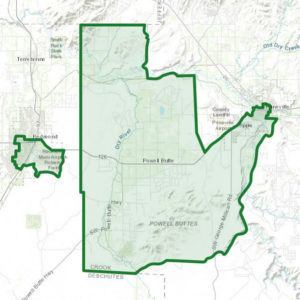

West of Prineville, there are vast expanses of inexpensive land in the OZ that are on the national radar, following the construction of the Facebook and Apple data centers. The confluence of tax advantages and utility subsidies in this area should continue to make this area an attractive target for investors and owner-users alike.

The OZ boundary in Redmond was drawn south of Evergreen Avenue/Highway 126 and from SW 23rd Street westward past the airport. This area has plenty of vacant land as well as finished construction with industrial zoning to the east and residential/commercial zoning to the west. (See full Oregon opportunity zone interactive map here.)

Opportunity Zones In Conclusion

Whether one approves or disapproves of the tax law that was passed, as a whole, Subsection Z seems to address its intended objectives. It encourages investment real estate located in the bottom 25% of socioeconomic locales across the US, and it encourages holding these investments for extended periods of time. Investors looking to take advantage of Opportunity Zones should consult in-depth with their tax professional to make sure they are meeting all the criteria required to participate in the program as the rules are quite subjective and mercurial.

If you would like to learn more about the OZs in Central Oregon, please contact brokers Adam Bledsoe or Joel Thomas, CCIM at Compass Commercial Real Estate Services by calling 541.383.2444.