The Central Oregon multifamily market remains strong and stable in the face of the double daunting headwinds of a worldwide pandemic and a statewide regulatory environment that is intensely anti landlord. COVID has accelerated the trending in-migration to Central Oregon. The population growth has mitigated the potentially damaging impacts of rent control and eviction moratoriums.

New construction is robust and units are being absorbed. Vacancy rates have ticked up a bit, but rent growth has spiked.

New construction is robust and units are being absorbed. Vacancy rates have ticked up a bit, but rent growth has spiked.

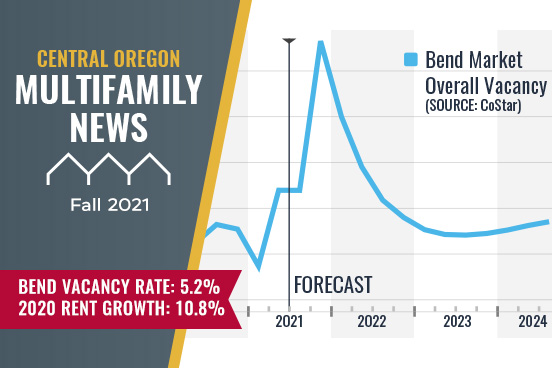

VACANCY: According to CoStar, multifamily inventory has increased by nearly 60% since 2016. The strong absorption and rent growth are remarkable given this increase in supply. CoStar is forecasting a climb in the vacancy rate into next year to around 8% before stabilizing again around the 4% mark. The long-term historical vacancy rate for Bend averages around 5%.

RENT GROWTH: Bend rent growth posted an annual gain of 10.8% compared to 10.3% nationwide, as of Q3 2021. Bend rent growth has averaged 4.5% annually over the last 10 years, with cumulative gains of 61.8%. CoStar predicts that this growth is at a peak with slowing over the next 5 years.

RENT GROWTH: Bend rent growth posted an annual gain of 10.8% compared to 10.3% nationwide, as of Q3 2021. Bend rent growth has averaged 4.5% annually over the last 10 years, with cumulative gains of 61.8%. CoStar predicts that this growth is at a peak with slowing over the next 5 years.

SALES: Sales in 2021 have been muted, primarily due to a lack of sellers. Buyer demand is exceedingly strong with regional and national firms, individual and locally based investors, and even some light institutional interest. 1031 exchanges remain a driving force in the market. Sellers are reluctant to transact while experiencing strong operational profits, aversion to capital gains taxes, and a hesitancy to enter the limited 1031 market. The Democratic proposed tax increases, including a large increase in capital gains taxes, are making property owners nervous. There is much uncertainty and no clear path to a safe harbor for tax and estate planning.

Contact us for a copy of the complete 29-page CoStar report summarized in this newsletter.

The Compass Commercial Multifamily Brokerage Team specializes in Central Oregon multifamily properties of all sizes and types from duplexes to 200+ units.

To find out about new multifamily listings, sign up for new listing alerts by going to: compasscommercial.com/mfnews.