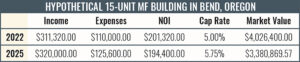

The market has shifted — and with it, so have investor expectations. One of the most common questions we get today is: “How has the changing market impacted the value of my multifamily asset?” To answer that, we need to look at three core fundamentals: income, operating expenses, and capitalization rates.

Income

After years of consistent rent growth, rents in the Central Oregon multifamily market have flattened over the past three years. In some submarkets, they’ve even declined—some properties have experienced drops of up to 20%. This trend is largely driven by oversupply: currently, about 1,000 apartment units sit vacant in Bend and Redmond, with an additional 1,000 units either newly delivered or expected within the next 18 months.

To attract tenants, landlords are offering major concessions—up to two months’ free rent and reduced security deposits.

Operating Expenses

At the same time, operating costs have jumped significantly:

• Electricity: up 42% over three years

• City of Bend water/sewer: up 27%

• Property taxes: up 12%

• Insurance: up 25–50% or more

Capitalization rates

Cap rates have also risen. Since they’re closely tied to interest rates—which are significantly higher than three years ago—investors now demand greater returns to offset higher borrowing costs and opportunity costs.

This example shows a 16% decline in market value, consistent with the 15-20% range we’re seeing across the board.

What will it take to reverse the trend? Several things will need to happen:

• Sustained population growth to absorb excess inventory

• Stabilized operating costs

• Lower interest rates to boost investor returns

In the meantime, the region’s housing shortage has been eased. Housing is more affordable. Incomes have risen, while rents have stayed flat or declined. This is part of a typical real estate cycle: shortages lead to overbuilding, which creates surplus, then construction slows until demand catches up again. These cycles have been more volatile in recent years, influenced by events like the 2007 financial crash, COVID-19, and Central Oregon’s rapid growth. It’s safe to assume the cycle will continue. Over the next several years, we’re likely to see the market re-balance—or even swing back to a shortage. And higher interest rates create a larger renter pool as many would be home buyers remain renters. This could be a great entry point for investors that have been unable to find attractive deals in recent years.

The Compass Commercial Multifamily Brokerage Team specializes in Central Oregon multifamily properties of all sizes and types from duplexes to 200+ units. Contact us today for a free Broker Opinion of Value on your property.