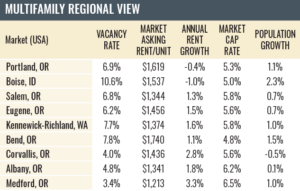

Real estate markets are localized, and the focus of this newsletter is Central Oregon. But there is a regional connection. Understanding the broader perspective can be interesting and instructive.

The data on the Bend market encompasses the entire Deschutes County, so it will be referred to as Central Oregon. That data confirms that Central Oregon has the highest rents in the region. It also has the second highest vacancy rate behind Boise and has the lowest market cap rate in the region.

Central Oregon has the highest population growth rate in the state but lags Boise’s explosive growth. Central Oregon growth has slowed substantially to about half of what it was at its peak during the COVID years. Thus far, Central Oregon is absorbing new units with minor concessions being offered. One month of free rent is common. Property managers are optimistic that spring will bring increased positive lease up activity.

There remains a huge pipeline of new units coming online in the next year or two. This will likely keep rents flat and bump up vacancies a bit. Good news for renters. But vacancies should remain manageable for landlords and developers.

Oregon leads the nation in statewide rent control legislation. The law was just amended to cap rents at a maximum 10% increase. According to CoStar, “However, even if rent increases are further restricted, the Bend area’s historical average annual rent growth performance trends to 2.9%. Therefore, it appears an organically growing construction pipeline is likely a more outsized deterrent to rent growth than legislative initiatives.”

INSURANCE ALERT

In light of prevailing challenges within the insurance landscape, property owners must be proactive. Escalating occurrences and severity of natural disasters, coupled with soaring construction costs, crime, and a litigious environment pose significant hurdles for insurers. Consequently, consumers are experiencing unprecedented rate hikes, diminished coverage, elevated deductibles, and even the prospect of insurance unavailability. Older properties are the most at risk. Budget for rate increases and work with your insurer to implement risk mitigation strategies such as fire prevention and infrastructure maintenance and upgrades.

FACING A REFINANCE?

There is a notable contrast between 2–4-unit properties and those with 5 units or more when it comes to financing. Properties with 2–4 units are classified as residential and qualify for 30-year fixed-rate conventional financing. The advantage of securing a fixed rate for 30 years eliminates interest rate risk, a significant benefit, especially during times of rising rates.

In contrast, properties with 5 units or more are categorized as commercial. These loans typically have terms of 10 years or less, requiring refinancing at the end of the term. This exposes owners to considerable interest rate risk, particularly when the current loan rate is below 4% and the refinance rate is 7%, a situation many property owners are facing today.

Plan ahead for your refinance. Ensure your property is operating efficiently. Budget for reduced cash flow. Prepare for the potential need for a cash or equity infusion. Consider a sale.

If you need assistance, please feel free to contact us.