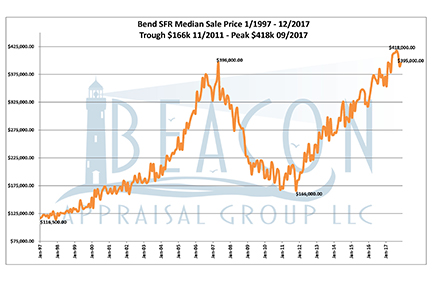

Residential Update: 20 year Bend real estate trend

At Compass Commercial, we keep an eye on market trends in commercial real estate, but also residential real estate. One company we look to for

ITR Economic Forecast for 2017 and beyond

Our team participated in a webinar last month from Brian and Alan Beaulieu at ITR Economics, providing economic insights for the coming years. In summary,

Compass Commercial Helps Fund Bethlehem Inn’s Growth

Last October, Compass Commercial Real Estate Services celebrated their 20th anniversary with a benefit event. Proceeds were donated to local nonprofits Bethlehem Inn and Shepherd’s

Oregon Launches Initiative to Spur Rural Entrepreneurship

This week while participating in the Coastal Caucus Summit in North Bend, Business Oregon announced the launch of its new Rural Entrepreneurship Development Initiative (REDI),

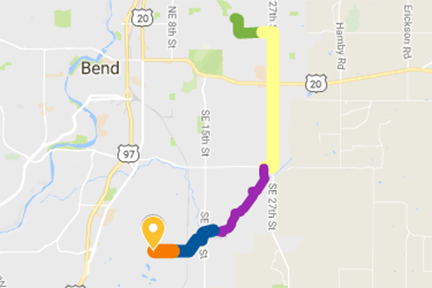

City of Bend News – 27th St. Sewer Line Project

27th Street Sewer Line Project Source: City of Bend News 8/4/2016 The two-year-long 27th Street Sewer Line project kicks off Monday, starting with up to eight

Traffic Advisory: Weekend Road Closures

Plan for weekend traffic or plan a new route! Summers in Bend are amazing! Of course, the plethora of activities that routinely take place throughout the city

Bend & Redmond with biggest job growth

Bend/Redmond tops the U.S. Metro list of fastest job growth in 2015. Source: Portland Business Journal June 30, 2016 Erik Siemers, managing editor of the Portland