IS THE COMMERCIAL REAL ESTATE MARKET BEGINNING TO LAG?

Cover Article By Howard Friedman, CCIM

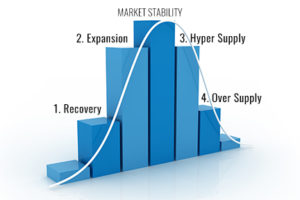

It’s not hard to hear the warnings of an impending downturn in commercial real estate if you pay attention to economic prognosticators. And if you are old enough to have seen the cycles of real estate, you know that another downturn is inevitable. One question is…when? And the other, will Central Oregon be insulated from it all?

Some caution signs may be looming, even though it appears all is currently rosy. If you look at our quarterly survey results in this issue of Points, the current state of the market certainly seems positive. And maybe that is the problem. What factors could change all this? Here are a few.

One nationwide factor is the slow rise of interest rates, while cap rates are at historic lows. The result is a narrowing gap between a borrower’s interest rate and their rate of return from investments is shrinking dramatically. Commercial rates are now in the 4.75–5.10% range, while cap rates for quality product in our area are hovering around the 5.5% rate, with some trophy properties even lower. This narrowing gap does not provide much cushion of safety for say, unplanned vacancies, tenant improvement dollars to re-tenant empty spaces, or other unforeseen expenses.

Another indicator is the leveling off of lease rates. While we are still in a landlord’s market, with low vacancies and scarcity of new construction starts (due to high land and building costs), but we are seeing rents in the office, retail and industrial markets begin to slow in their increases. And more projects are on the horizon, as we will explore later.

Investors on the other hand, are seemingly more cautious in their purchases of late, with much more due diligence time and investigation requirements requested in their offers. It would seem that this is a direct result of the aforementioned narrow gap between borrowed funds and bottom line income, providing the buyer with more assurances of a solid investment and mitigated risk.

Sellers are optimistically listing properties on the market at very high values, trying to capture a heated economic environment and often leaving out first-time or cautious investors, while focusing on cash buyers or 1031 exchange opportunities where buyers must place their money to avoid tax penalty. This contributes to the frenzy of trying to get into the real estate market and excludes many would-be investors that cannot obtain a loan.

One could argue that there is not enough new construction in Bend and Central Oregon to cause the Hyper Supply cycle to exist, but there are many new projects on the drawing board, some significantly larger than any we have seen in the area to date. The impending rebuild of the Ray’s Westside complex, Brooks Resources’ plans to eventually redevelop the former Murray & Holt in Bend’s Central District, the north end Robal Road expansion, the Box Factory’s plans to expand eastward, and 193,000 square feet of new industrial buildings in Redmond are just a few of the very large plans currently on the drawing board in Central Oregon. These multi-tenant, and in some cases multi-story ventures will change the supply vs. demand equation in the near future and could contribute to an eventual downturn in the cycle.

Of course, many outside factors help to shape real estate cycles, including global influences and political changes within the U.S. and for a time prior to the previous recession it seemed that Central Oregon was immune to those impacts, but those who lived here from the mid-2000s to the mid-2010s, know it will affect us all. ‘When’ is the looming question?

Howard Friedman is a partner and the managing principal broker at Compass Commercial. He joined the firm in 1999.

To view the complete report and receive the quarterly publication, sign up at https://www.compasscommercial.com/POINTS or call (541)383-2444.

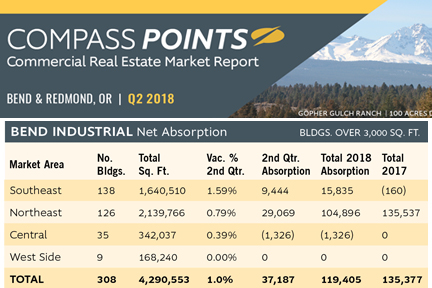

Compass Points® is a quarterly publication of Compass Commercial Real Estate Services offering comprehensive surveys of the Central Oregon commercial real estate market. The report provides a detailed look at quarterly vacancy and absorption data in office, retail and industrial product types throughout Bend’s primary submarkets, as well as the Redmond industrial market. Absorption data contained in the report pulls from samples of buildings over 3,000 sq. ft.