Recently, Ron Ross, CCIM was published in the Cascade Business News for an article on what we can learn locally in Central Oregon about the multifamily industry from national trends. Below is an excerpt of the article as published by CBN. Read the full article as published in the CBN here.

“Real estate markets are no doubt independently local in nature. Central Oregon seems to be as wildly independent as anywhere in the country. As a sub-tertiary market, we have always been more volatile both on the way up and the way down. In the good times, we command surprisingly low cap rates driven by limited supply and strong investor demand. During the most recent recession we crashed harder than most places, but recovered strongly and rapidly.

However, we should still observe and learn from national trends. We are not an island, nor are we immune from national market forces. It has long been observed that Central Oregon has a strong correlation with both California and Portland markets, and to a lesser degree, Seattle.

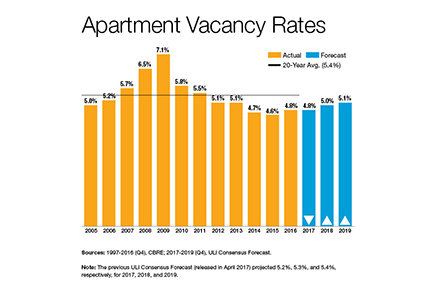

In the November/December issue of the Commercial Investment Real Estate magazine from the CCIM Institute an insightful article by Beth Mattson-Teig entitled Sailing Ahead: Will the renter pool keep up with the robust development pipeline? points out the following national trends:

1. Continuing strong, but slowing demand for apartment rentals.

2. Record levels of new construction.

3. …”

Read the full article as published in the CBN here.

*Graphic reprinted with permissions from Commercial Investment Real Estate, the magazine of the CCIM Institute, November 1, 2017, Vol. XXXVI, No. 6.

Learn more at www.ccim.com/cire-magazine

If you wish to read the article referenced in Ron’s article from Commercial Investment Real Estate in full, click here.