For the last ten years, multifamily housing providers have enjoyed a Goldilocks environment. In a word, “perfect.”

- Rapidly rising rent rates: In Central Oregon, rents rose an average of 5% annually or 70% cumulatively over the last ten years. Inflation was less than 2% for a cumulative rise of 27%.

- Modest new deliveries to the market with rapid absorption. Near-zero vacancy rates.

- Stable operating costs.

- Low interest rates and cap rate compression: Statewide multifamily properties have been trading at around 4.5% cap rates and, in some cases, even lower.

THE WINDS OF CHANGE ARE STIRRING

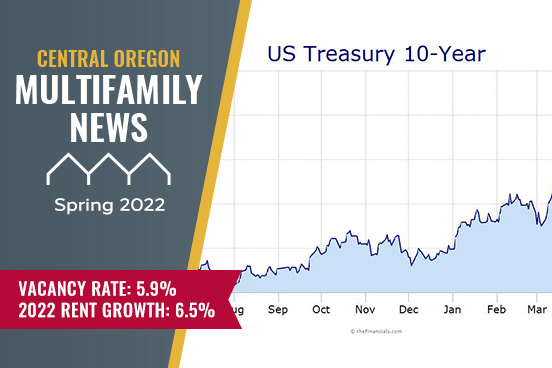

Inflation is here, and interest rates are skyrocketing. Rates are up 100 basis points in the last month and 200 basis points since the beginning of the year. Buyers can no longer make acquisitions, and lenders can no longer underwrite at 4.5% cap rates. Cap rates must go up, putting pressure on property values.

Inflation is already impacting operating costs. Property owners are experiencing sticker shock with insurance renewals, maintenance and material costs are through the roof, and utility costs are increasing.

In Bend and Redmond, new deliveries to the market are exploding with thousands of new units under construction or in the pipeline. The vacancy rate has ticked up to 5.9%, reflecting new inventory in lease-up mode. That is the highest metro area vacancy rate in the state. Existing units are not yet feeling this vacancy. It remains to be seen whether the region’s robust growth, including job growth, can absorb all the new supply. The good news is the housing shortage will certainly be eased by the multifamily construction boom. It is unlikely that housing costs will come down in this inflationary environment, but the growth rate of housing costs may flatten or plateau due to increased supply.

In Bend and Redmond, new deliveries to the market are exploding with thousands of new units under construction or in the pipeline. The vacancy rate has ticked up to 5.9%, reflecting new inventory in lease-up mode. That is the highest metro area vacancy rate in the state. Existing units are not yet feeling this vacancy. It remains to be seen whether the region’s robust growth, including job growth, can absorb all the new supply. The good news is the housing shortage will certainly be eased by the multifamily construction boom. It is unlikely that housing costs will come down in this inflationary environment, but the growth rate of housing costs may flatten or plateau due to increased supply.

IS THE GOLDILOCKS ERA OVER?

Probably for a time, but multifamily ownership will remain one of the top income-producing and wealth-building investment options for investors across the board. Housing is essential, and demand remains healthy. Central Oregon is booming. The macroeconomy is entering a slowing stage with strong headwinds, but a recession is not imminent. Owners will need to sharpen their pencils and pay attention to the management and operation of their properties, be sure rents are keeping pace and closely monitor operating costs.

Those making buying and selling decisions will need to weigh these changing trends. The Compass Commercial Multifamily Team is here to help. We specialize in Central Oregon multifamily properties of all sizes and types, from duplexes to 200+ units. We love to hear from multifamily property owners, lenders, and others in the field. Contact us anytime!