Growth Spurts: Bend Commercial Real Estate Rides the Wave of Change

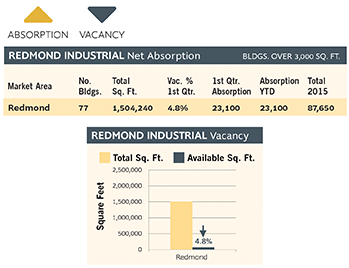

Bend’s office, industrial and retail vacancies are at or near record lows of 6.3%, 3.4% and 4.7% respectively, while Redmond’s industrial vacancy is just 4.8%.

The snail’s pace at which the Bend UGB is reaching approval should be mentioned, as it invariably affects the local real estate market and Bend’s economy as a whole. With a lack of buildable land, we have seen land prices soar to pre-recession levels, which will make new commercial and industrial construction projects difficult for developers to pencil.

On the other hand, developers are starting to conceive infill projects, which was the intention of the state remand of Bend’s originally requested 8,000 acre UGB expansion. The fallout required the city to conduct numerous feasibility studies and land use surveys to arrive at its current modified request for just over 2,000 acres to accommodate 20 years of expansion. It should be noted that Redmond requested a similar amount of land in its recent UGB expansion to accommodate a community one-third the population of Bend’s.

Several of these infill projects are already underway or are currently on the drawing board. A local developer recently paid over $40.00 per sq. ft. for commercial land on 3rd Street (which technically included three buildings that will be torn down) to build a 9,400 sq. ft. retail building on .71 acres. Lease rates are pushing the envelope at $3.00 per sq. ft. on a triple net basis, but the complex is already almost fully pre-leased, demonstrating the demand for new retail in our hot market.

The Crane Shed Commons office building under construction on Industrial Way has solid prospective tenants currently vying to move into the 50,000 sq. ft., four-story Class A building, where lease rates are listed at $2.25-$2.50 per sq. ft. triple net. In northeast Bend, the former Fuqua Homes manufacturing plant has been redeveloped as the Murray Road Industrial building which already has leased over half of the 115,000 sq. ft. project.

Yes, big changes are on the horizon with a four-year university adding to the population, but the growth promises to infuse our community with a new breed of talented, young people that will eventually join our work force and contribute to our growing economy. Whether you’re a proponent of urban density or not, economic growth through the development of our community’s human resources is something we can all appreciate.

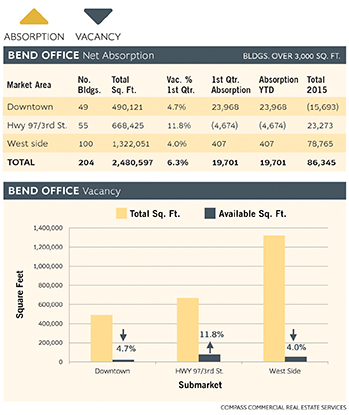

Bend OFFICE Market

The downtown submarket recorded a healthy 23,968 sq. ft. of positive net absorption during the first quarter, due mainly to a large lease at the Riverpointe One Building on Wall St. in which over 19,000 sq. ft. was leased, taking the building to 100% occupancy. The downtown office vacancy rate fell significantly to 4.7%, down from 9.4% at the end of 2015 with four buildings recording positive absorption and just one building with negative absorption in the quarter. There is currently 23,174 sq. ft. available downtown.

The Highway 97/3rd St. corridor recorded 4,674 sq. ft. of negative net absorption in Q1. Six buildings reported positive absorption and four buildings reported negative absorption. The vacancy rate for the submarket increased from 10.3% to 11.8% as a result.

The west side submarket recorded just 407 sq. ft. of positive absorption. Six buildings reported positive change and seven were negative during the quarter, with the largest lease signed at Building 1000 in the Mill Point Business Campus of 4,100 sq. ft., filling that six building complex completely. The vacancy rate dropped slightly to 4.0% from 4.03% in Q4 2015.

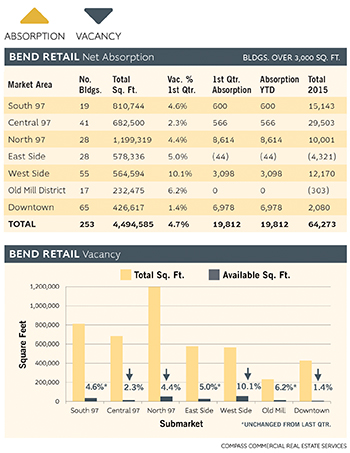

Bend RETAIL Market

Compass Commercial surveyed 253 retail buildings totaling nearly 4,495,000 square feet for the first quarter report. The citywide vacancy rate fell again, to 4.7% from 5.2% at the end of 2015, the result of another 19,812 sq. ft. of positive absorption.

Five out of the seven retail submarkets in Bend recorded positive net absorption, one was negative, and one was left unchanged in the quarter. The north Highway 97 and downtown submarkets led the retail survey results, recording 8,614 sq. ft. and 6,978 sq. ft. of positive net absorption, respectively. The downtown submarket is now the leader in occupancy with just 6,068 sq. ft. available, or 1.4% of the retail space, in the 65 retail buildings located downtown. The west side remained the highest at 10.1%, still due to the stubborn vacancy of 43,000 sq. ft. at the former Ray’s Food Place building in the Westside Village shopping center, although there have been a few very strong prospects of late which may result in absorption of the space later this year. The east side was the only loser in the absorption category, albeit at a minimal loss of only 44 sq. ft. of absorption. .

Citywide, there were a few notable retail leases that took place in the quarter, including the backfilling of the former Connecting Point building on Franklin Ave. downtown, with L.I.F.T. personal trainer (formerly Body by Schliebe) taking the entire 6,978 sq. ft. building. Eyemart Express came to town earlier this year, occupying the former Fed Ex Office building in the Bend River Promenade complex, leasing 4,524 sq. ft., and 4,090 sq. ft. was leased at 63830 Clausen Dr. to the Drum and Guitar Shop, who took over the old Globe Lighting space. Old Mill District developers also indicate that the former Orvis building should have a lease signed before the end of Q2, taking the majority of the 10,000+ sq. ft. vacancy with a tenant that will be a welcome addition to the area. The largest vacancy of the quarter took place at Old Mill Marketplace, soon to be renamed the Box Factory, where a 6,637 sq. ft. space went dark.

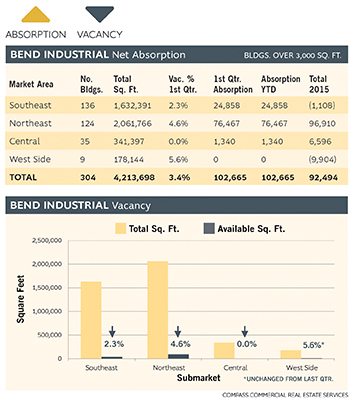

Bend INDUSTRIAL Market

Three of the four submarkets recorded positive absorption, while the small west side submarket remained unchanged at 5.6% with no activity and only one 9,900 sq. ft. space still available.

The southeast submarket recorded 24,858 sq. ft. of positive absorption, dropping the vacancy rate from 4.4% to 2.3% at the end of Q4. Nine buildings reported positive net absorption while only two recorded negative. Carmen Loop was the hub of activity with four buildings reporting positive activity and a total of just over 18,000 sq. ft. leased, plus one loss of 2,400 sq. ft. The largest loss in the southeast submarket was of 7,350 sq. ft. at the corner of Reed Market Rd. and 9th Street.

The northeast submarket recorded the strongest activity with 76,467 sq. ft. of positive net absorption in the first quarter. The Murray Road Industrial Park was the biggest winner with nearly 46,000 sq. ft. reported leased in the former Fuqua Homes facility, and Humm Kombucha leased 30,000 sq. ft. in the former Advanced Energy building on SE Brinson Blvd. Overall, four buildings reported positive absorption, and three reported negative. The vacancy rate decreased nicely as a result from 8.1% to 4.6%.

The central submarket leased the last available space in the first quarter, resulting in a 0% vacancy rate, down from 0.4% at the end of Q4.

Redmond INDUSTRIAL Market

Redmond continued its astounding comeback once again in the first quarter of 2016. The 1.5 million square foot industrial market recorded another 23,100 sq. ft.

Compass Commercial’s Q1 2016 issue of Compass Points provides data on office, industrial and retail absorption and vacancy rates in Bend and Redmond industrial. View the complete report or sign-up to receive Compass Commercial’s monthly newsletter, the Compass Navigator including quarterly market updates at compasscommercial.com or by calling (541) 383-2444.

About Compass Commercial Real Estate Services

With integrated services in brokerage sales, leasing, asset and property management and construction services, Compass Commercial helps buyers, sellers, landlords and tenants achieve their unique commercial real estate goals. Today, the company celebrates 20 years of serving clients in Central Oregon, continuing a tradition of excellent client service and superior market intelligence. The team’s collective industry expertise includes Central Oregon’s only two Society of Industrial and Office Realtors (SIOR®) designees, 11 Certified Commercial Investment Members (CCIM), 3 Certified Property Manager (CPM®) designees and the distinguished Accredited Management Organization (AMO®) designation from the Institute of Real Estate Management. Learn more at www.compasscommercial.com. Follow us on Twitter @CompassCom.