What’s Your Real Estate Exit Strategy?

Many of our clients are entering the “fourth quarter” of their real estate journey. Their properties have generated solid cash flow and long-term appreciation, creating

Many of our clients are entering the “fourth quarter” of their real estate journey. Their properties have generated solid cash flow and long-term appreciation, creating

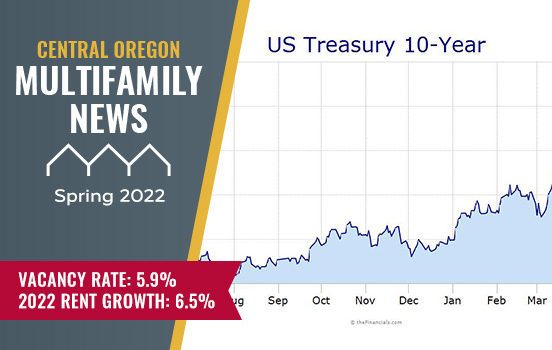

The market has shifted — and with it, so have investor expectations. One of the most common questions we get today is: “How has the

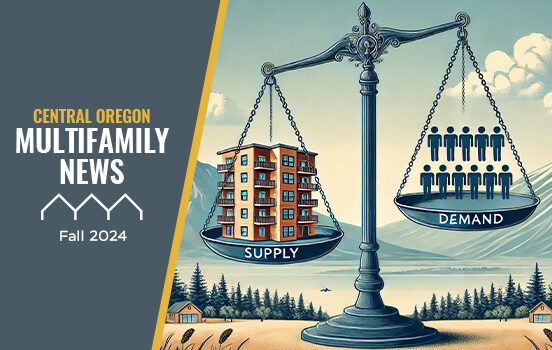

Supply and demand is arguably the most fundamental principle of real estate markets. About 18 months ago, we wrote on this same topic, but an

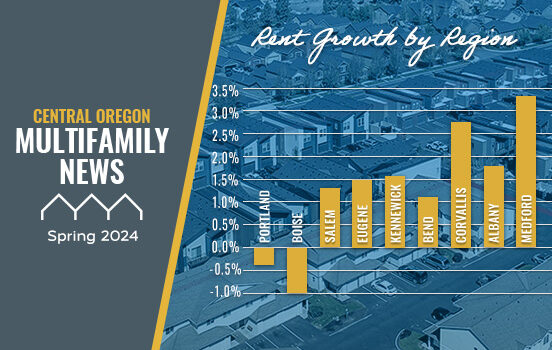

Real estate markets are localized, and the focus of this newsletter is Central Oregon. But there is a regional connection. Understanding the broader perspective can

Central Oregon has experienced remarkable population growth over the last decade, driven in part by its appeal to outdoor enthusiasts and a robust job market.

Achieving supply and demand equilibrium is always challenging. Just ask any small business owner (think restaurants). In the housing market, it is an ongoing sequence

A Cap Rate, short for Capitalization Rate, is calculated by dividing the Net Operating Income (NOI) by the Purchase Price. NOI is the net cash